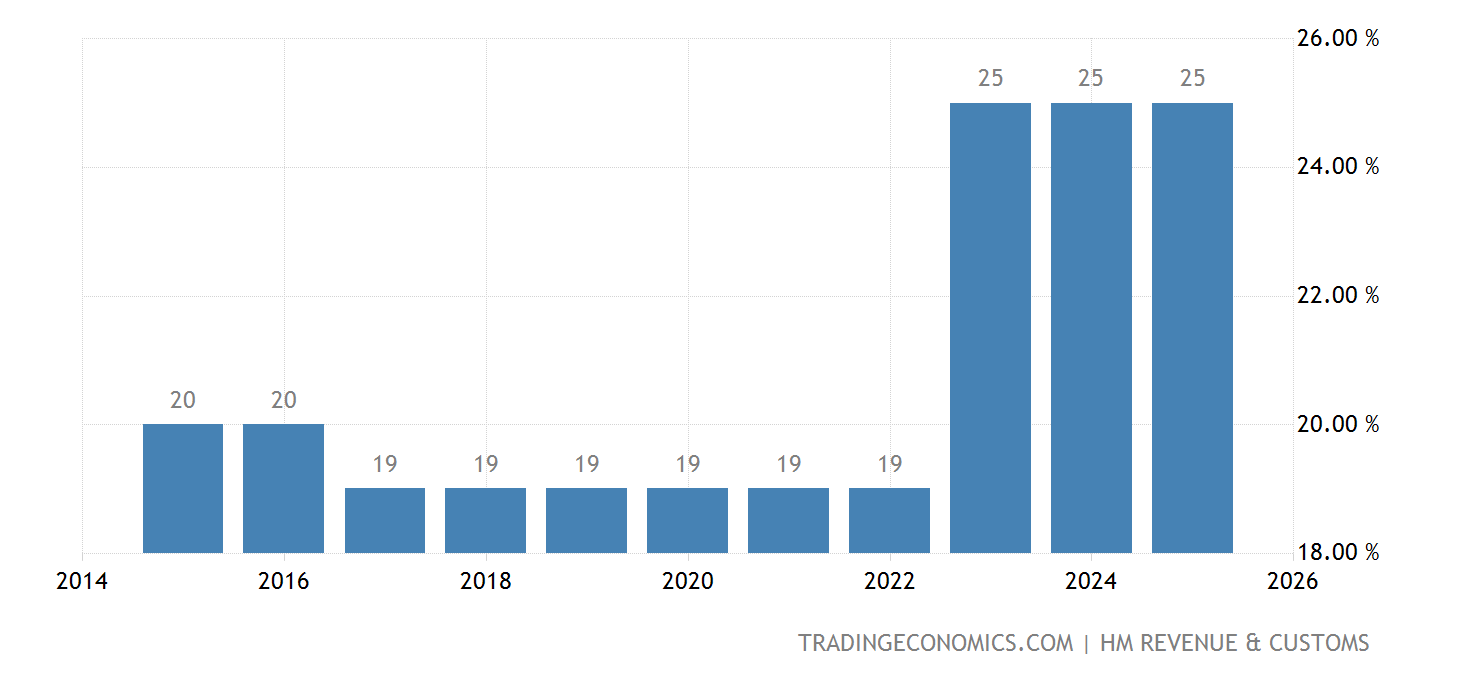

Uk Corporation Tax Rates 2024/25

Uk Corporation Tax Rates 2024/25. Added 19% corporation tax rate changes from 2017/18. 1) main rate of 25 percent, for companies with profits over 250,000 british pounds (us$314,674);

A small profit rate applies to. What is the rate of corporation tax?

On 1 April 2023, The Main Rate Of Corporation Tax Increased From 19% To 25%.

Corporation tax small profit rate:

The Corporation Tax Rate Will Increase To 25% From 1 April 2023, Affecting Companies With Profits Of £250,000 And Over.

A welcome reduction in the rate of capital gains tax.

Corporation Tax In The Uk Is A Corporate Tax Levied On The Annual Profits Made By Uk Resident Companies And Branches Of Overseas Companies.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, 19% (under £50,000 taxable profits) * corporation tax main rate: From april 2023, corporation tax rose from 19% to 25%.

Source: ellynnqannalise.pages.dev

Source: ellynnqannalise.pages.dev

What Are The Different Tax Brackets 2024 Eddi Nellie, 3 the main rate of corporation tax remains at 25% for. Small company rate and main rate are now unified at 20.

Source: eirenaqpatrizia.pages.dev

Source: eirenaqpatrizia.pages.dev

Uk Corporate Tax Rate Increase 2024 Dael Casandra, 3 the main rate of corporation tax remains at 25% for. Small company rate and main rate are now unified at 20.

Source: www.taxpayersalliance.com

Source: www.taxpayersalliance.com

UK Taxes Potential for Growth TaxPayers' Alliance, Corporation tax small profit rate: This is applicable for businesses reaching £250,000 in taxable profits.

Source: marketbusinessnews.com

Source: marketbusinessnews.com

Corporate tax definition and meaning Market Business News, Corporation tax small profit rate: This flat rate remained up until.

Source: www.statista.com

Source: www.statista.com

Chart Global Corporation Tax Levels In Perspective Statista, For businesses with accounting periods which straddle 1 april, profits are time. The corporation tax rates uk history show a trend of decrease.

Source: jackquelinewkoo.pages.dev

Source: jackquelinewkoo.pages.dev

2024 Tax Brackets And Rates carlyn madeleine, 3 the main rate of corporation tax remains at 25% for. This flat rate remained up until.

Source: cigmaaccounting.co.uk

Source: cigmaaccounting.co.uk

UK Corporation Tax Changes 2023 CIGMA Accounting, What is the rate of corporation tax? From 1 april 2023, the main rate of corporation tax increased from 19% to 25%, and a new 19% small profits rate of corporation tax was introduced for companies whose profits do.

Source: www.freeagent.com

Source: www.freeagent.com

UK Corporation Tax rate 2021/22 FreeAgent, A welcome reduction in the rate of capital gains tax. Cgt rates and annual exemptions.

Source: www.thescottishsun.co.uk

Source: www.thescottishsun.co.uk

Corporation tax WILL be hiked to 25 from April risking Tory backlash, 3 the main rate of corporation tax remains at 25% for. In a move to support economic growth while ensuring fair contributions from.

In A Move To Support Economic Growth While Ensuring Fair Contributions From.

A welcome reduction in the rate of capital gains tax.

Changes To Corporation Tax From 1St April 2023.

From april 2023, corporation tax rose from 19% to 25%.