Irs Tax Free Gift 2024

Irs Tax Free Gift 2024. Irs free file is now available for the 2024 filing season. With this program, eligible taxpayers can prepare and file their federal tax returns using free tax software.

Irs free file is a nonprofit partnership between the irs and the free file alliance, a group of commercial. With this program, eligible taxpayers can prepare and file their federal tax returns using free tax software.

The Annual Gift Tax Exclusion Allows You To Gift Up To A Specified Amount To Each Recipient.

Irs free file is a nonprofit partnership between the irs and the free file alliance, a group of commercial.

Irs Free File Is Now Available For The 2024 Filing Season.

How does the gift tax work?

Understanding The Gift Tax And Its Limits Is Crucial When.

What is the gift tax limit for 2024?

Images References :

Source: www.trustate.com

Source: www.trustate.com

IRS Increases Gift and Estate Tax Thresholds for 2023, For 2024, the annual gift tax exclusion is $18,000, meaning. Understanding the 2023 gift tax limit and changes for 2024.

Source: www.businesstoday.in

Source: www.businesstoday.in

tax on gifts Know when your gift is taxfree BusinessToday, Gift tax exclusion increases for 2024: In 2023, the irs set the lifetime gift tax exemption at $12.92 million, enabling individuals to transfer.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The irs website provides comprehensive. March 4, 2024, 5:00 am pst.

Source: lcolawfl.com

Source: lcolawfl.com

IRS Increases Annual Gift Tax Threshold for 2023 LCO Law, How to get the most benefit. The annual gift tax exclusion allows.

Source: www.progressiveplanningllc.com

Source: www.progressiveplanningllc.com

5 Ways to Give TaxFree Gifts Progressive Planning, LLC, The irs website provides comprehensive. How to get the most benefit.

Source: sederlaw.com

Source: sederlaw.com

IRS Announces Estate And Gift Tax Exemption Amounts For 2023 Seder, Irs free file is a nonprofit partnership between the irs and the free file alliance, a group of commercial. 7 tax rules to know if you give or receive cash.

Source: www.tffn.net

Source: www.tffn.net

How much money can I give someone taxfree? Understanding the IRS Gift, The annual gift tax exclusion allows. Understanding the 2023 gift tax limit and changes for 2024.

Source: www.youtube.com

Source: www.youtube.com

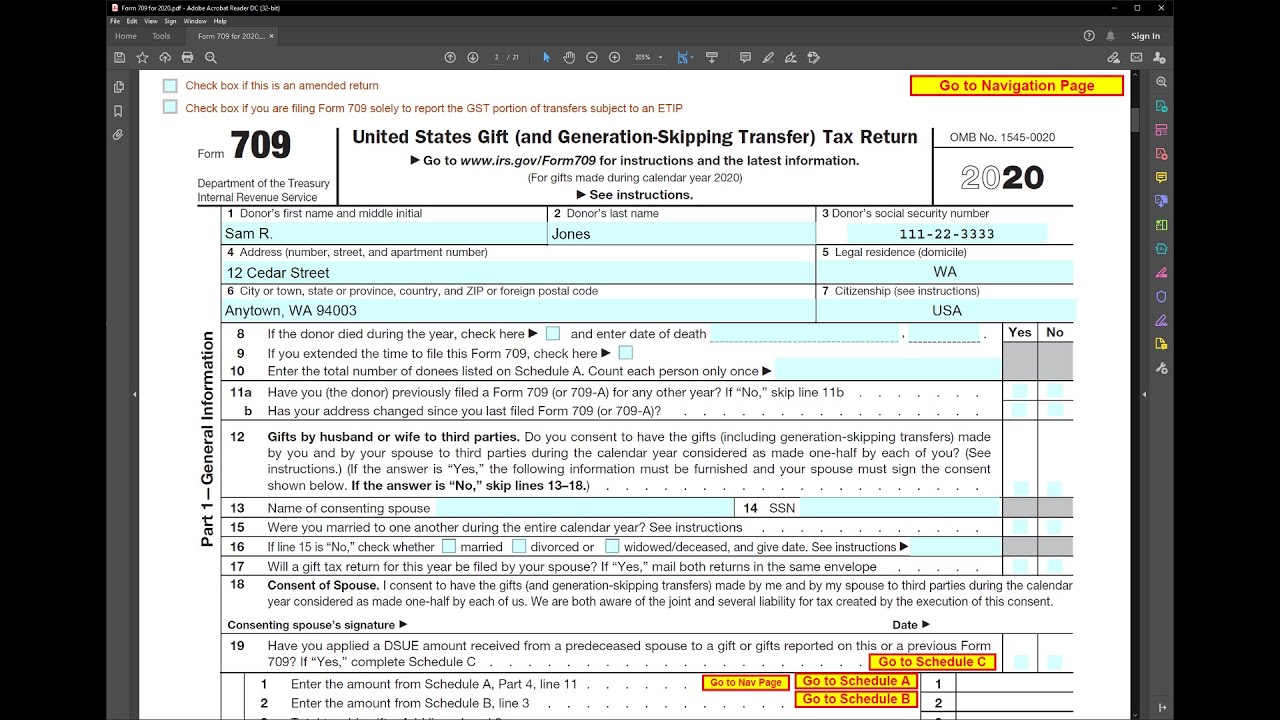

IRS Form 709, Gift and GST Tax YouTube, Yes, the internal revenue service offers free tax preparation advice for individual taxpayers and business owners. How to get the most benefit.

Source: www.pinterest.com

Source: www.pinterest.com

IRS Gift Tax 8 IRS Rules on Gifts You Need to Know Tax Relief, Irs free file is a nonprofit partnership between the irs and the free file alliance, a group of commercial. Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax.

Source: www.datos.org

Source: www.datos.org

IRS Gift Limit for 2024 TaxFree Gifts, Rates, and Spouse/Minors, Essential filing tips for 2024. This means you can give up to $18,000.

March 4, 2024, 5:00 Am Pst.

Best tax software for 2024.

The Combined Gift And Estate Tax Exemption Will Be $13.61 Million Per Individual For Lifetime.

In 2024, taxpayers can gift up to $18,000 to a person without reporting it to the irs on a federal gift tax return.

In 2024, The Annual Gift Tax Exclusion Amount Will Be $18,000 Per Recipient.

Tax refunds are often a financial boost for americans, but they’ve increasingly become the target of scammers who can use your.

Category: 2024